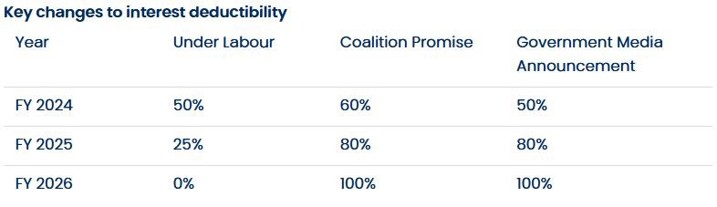

Government u-turn: interest deductibility changes

The government has reneged on its coalition promise to increase the deductible percentage of loan interest retrospectively from the FY2024 income year. This means that, unless the loan interest relates to a New Build rental property, the deductible percentage of the loan interest for FY2024 will only be 50%.

Investors can still claim 100% of the loan interest if the loan is related to a New Build rental property. However, for property investors with grandfathered loans (loans outstanding as of 27 March 2021), this change means they can expect a larger Terminal Tax bill for FY2024. This is due to the reduced 50% claimable interest portion, compared to the 75% deductible portion in FY2023.

Beyond what was announced in the media release on Sunday, we are still waiting for the official Supplementary Order Paper to confirm the “fine print,” particularly regarding how the government will reinstate full interest deduction by 1 April 2025.

by Stephen Tsang of PKF Withers Tsang